new mexico pension taxes

800-352-3671 or 850-488-6800 or. Ad Your Unique Pension Challenges Call For Customized Solutions.

Retirement Eligibility Nm Educational Retirement Board

A three-year income tax exemption for armed forces retirees starting at 10000 of military retirement income in 2022 and rising to 30000 of retirement income in tax year 2024.

. New Mexico Educational Retirement Board. Taxpayers 65 years of age or older. New Mexico Veteran Financial Benefits Income Tax.

Starting in 2022 all military retirees may exclude 50 percent of their military retirement benefits New Mexico. TaxAct helps you maximize your deductions with easy to use tax filing software. Snapshot of Te acher Retirement.

Retirement income exclusion from 35000 to 65000. Low-income taxpayers may also qualify for a property tax rebate even if they rent. A three-year income tax exemption for armed forces retirees starting at 10000 of military retirement income in 2022 and rising to 30000 of retirement income in tax year 2024.

New Mexico is well known for its low costing of living which is 31 lower than the average in the United States. Income Tax Range. The Cost of Living Is Low.

Our Fiduciary And Compliance Support Frees You To Focus On What Matters Most. New Mexico offers a deduction of 40 previously 50 of all capital gains or 1000 of reported net capital gains whichever is greater. New Mexicos law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New.

Managing the retirement assets of New Mexico Educators since 1957. Ad Over 85 million taxes filed with TaxAct. Not applicable no income tax.

Active duty military pay is tax-free. How All 50 States Tax Retirees. Retired Members tax documents 1099-R have been mailed out.

404-417-6501 or 877-423-6177 or. Median pension value 2018. According to the New Mexico Taxation and Revenue website Military Retirement is taxable and is included in gross income on the return.

Ad Download Fisher Investments free guide Is a Lump Sum Pension Withdrawal Right for you. Placitas located just north of Albuquerque has the lowest tax rate on this list at just 1610 so those looking for a city where they wont have to give too much to Uncle Sam. For more information see the Wyoming State Tax Guide for Retirees.

New Mexico public pensions are the state mechanism by which state and many local government employees in New Mexico receive retirement benefits. Disabled Veteran Tax Exemption. Could increased liquidity give you more control over your 500K in retirement savings.

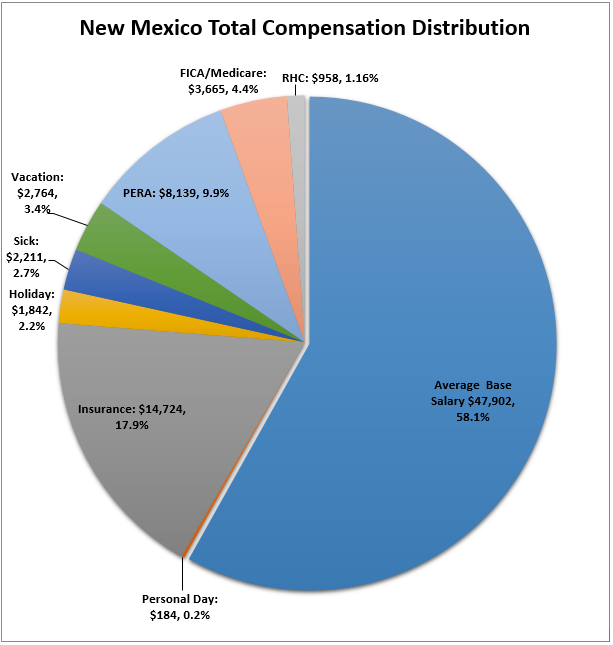

Average pension value 2018. Its important to note that New Mexico does tax retirement income including Social Security. Any veteran who rated 100 service-connected disabled.

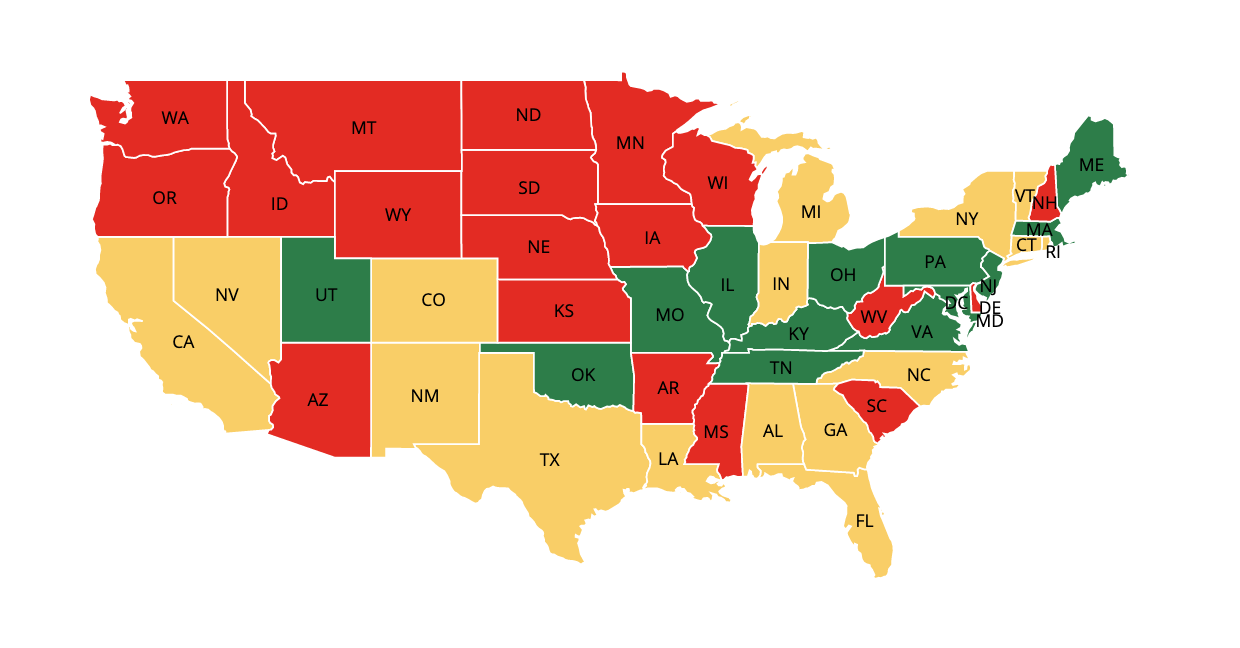

Railroad Retirement benefits are fully exempt but New Mexico taxes Social Security benefits pensions and retirement accounts. Does New Mexico offer a tax break to retirees. Taxable as income but low-income taxpayers 65 and older.

However many lower-income seniors can qualify. According to the United States Census. If you plan to supplement your retirement income with investment income remember that you pay tax on all capital gains.

However depending on income level taxpayers 65. SANTA FE HB 76 passed the House Labor Veterans and Military Affairs Committee with unanimous bipartisan support. You are 65 or.

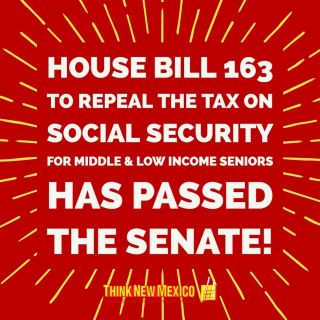

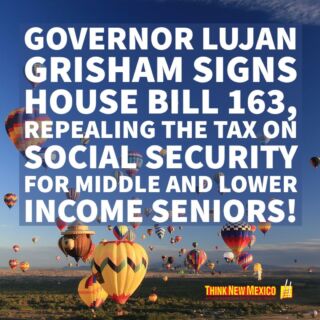

Removes the 90 percent salary cap on pensionable compensation. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each. New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security benefits.

New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted gross income if you meet one of the following. Start filing for free online now. Compared to many other popular retirement.

The bill would support retired veterans by. 52 rows Tax info. Michelle Lujan Grisham a Democrat signed.

The changed COLA is expected to vary between 05 and 3 each year and average out to 164 annually. Retirement Income Is Taxed.

New Mexico Retirement Tax Friendliness Smartasset

37 States That Don T Tax Social Security Benefits The Motley Fool

New Mexico Income Tax Calculator Smartasset

Retirement Security Think New Mexico

New Mexico Income Tax Calculator Smartasset

Retirement Security Think New Mexico

New Mexico Retirement Tax Friendliness Smartasset

What Happens To Taxpayer Funded Pensions When Public Officials Are Convicted Of Crimes Reason Foundation

How Taxes Can Affect Your Social Security Benefits Vanguard

Retirement Security Think New Mexico

New Mexico Income Tax Calculator Smartasset

How Well Funded Are Pension Plans In Your State Tax Foundation Pension Plan Pensions How To Plan

Retirement Security Think New Mexico

Retirement Security Think New Mexico

Retirement Security Think New Mexico

Where S My State Refund Track Your Refund In Every State Taxact Blog